The bitcoin price broke past $4,000 on Wednesday, headlining another generally-positive day

for the crypto markets. Few cryptocurrencies made eye-catching movements, but

most made moderate progress to extend the early-week market recovery.

Altogether, the markets added another $4 billion, bringing their combined

capitalization above the $140 billion threshold.

The total

cryptocurrency market cap began the day at $136.1 billion. It spent most of the

day on an incline, eventually reaching $141.8 billion at the time of writing.

The crypto market cap has grown by about $10 billion since the start of the

week, potentially indicating that traders are adjusting to the post-China bitcoinexchange ban environment.

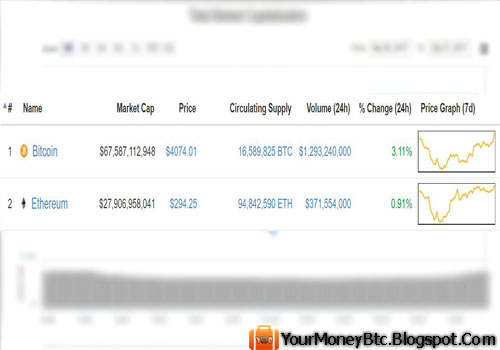

Bitcoin

Price Punches Through $4,000 :

Bitcoin

headlined the market advance with a march past $4,000. The bitcoin price had

been trading at this level a week ago but had succumbed to downward pressure

leading into the weekend, eventually reaching a weekly low of $3,555 on

September 22. However, it reversed course after reaching that mark and began to

scale the charts once again. Wednesday morning, bitcoin broke through $4,000

and has continued to climb, bringing its present value to $4,074. This

translates into a $67 billion market cap.

One factor

influencing bitcoin’s continued climb is the continued development of Asian cryptocurrency

infrastructure following China’s hostile stance toward order-book exchanges.

Both South Korea and Japan are expected to fill the void left by Chinese

bitcoin exchange giants such as OKCoin, Huobi, and BTCC. To that end, a popular

Korean messaging platform has announced plans to create a major cryptocurrency

exchange, while NXC–a Korean holding company for the $10 billion Japanese

gaming firm Nexon–has just purchased a majority stake in Korbit, Korea’s

second-largest bitcoin exchange.

Source: Cryptocoinsnews

Source: Cryptocoinsnews

No comments:

Post a Comment